This article is part of a blog series exploring how prefabrication and modular construction change the way structures are built.

Two of the trending methods of building sustainable constructions to reduce CO2 emissions are prefabrication and modular construction. These methods have a promising future thanks to:

The growth of the prefabrication and modular construction industry is fueled by:

Innovation is the key word for the prefabrication modular construction businesses as they can:

Modular construction and prefabrication methods offer:

According to a study by the University of Cambridge and Edinburgh Napier University, factory-produced homes in prefabrication and modular buildings emit up to 45% less carbon dioxide than traditional construction.

The prefabrications and modular construction methods are gentler on the environment than traditional methods. They:

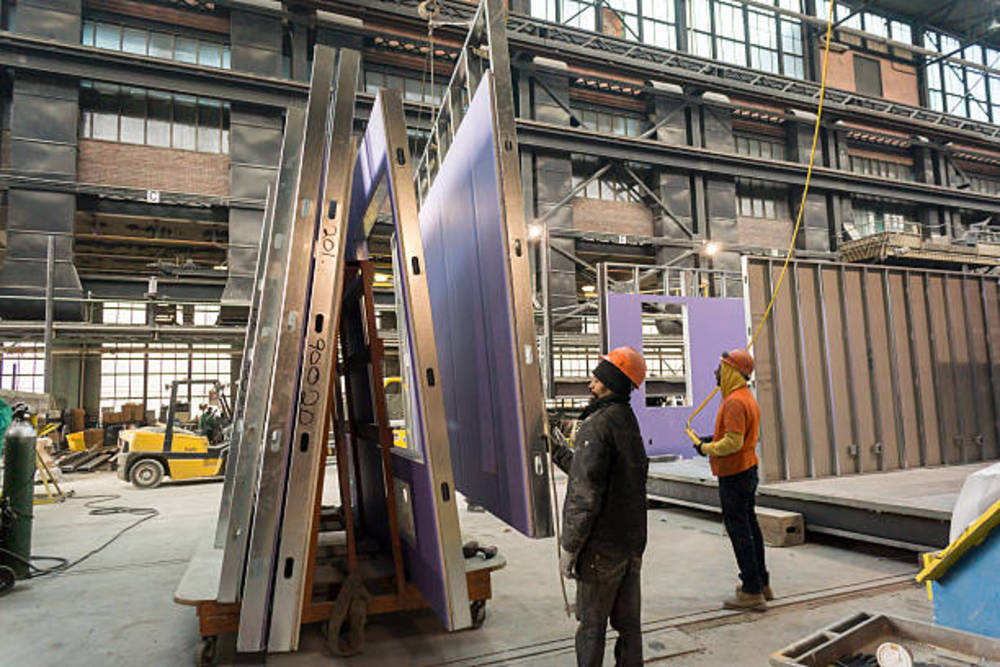

Both methods manufacture buildings or structures in factories and then deliver them to the site where they will be assembled, and professionally installed.

Are buildings built under these methods of poorer quality than traditional buildings? No, this is a myth as they:

Prefabricated buildings and structures may either be temporary/portable, or permanent standalone buildings.

Most of the prefabrication and modular construction are built in factories, and final adjustments are made on-site during installation. The result is that it mitigates the risks associated with extreme weather conditions, as modules and structures are fabricated in a climate-controlled environment.

The global modular construction market size was USD 79.92 billion in 2022 and is projected to grow to USD 131.58 billion by 2030.

Construction of modular buildings in comparison to traditional constructions are:

It is forecasted that spending on R&D for cutting-edge building solutions, following incentives from many governments worldwide, will boost the modular construction market share. The programs are driving changes that lessen construction waste and support green buildings.

As an example, let's have a look at the government of Singapore.

The program depends upon prefabricated prefinished volumetric construction (PPVC) elements. PPVC is a construction method that encapsulates 3-dimensional modules, internal finishes, fixtures, and fittings, in an off-site fabrication facility, before it is delivered and installed on-site.

The Singapore government also incentivizes businesses to standardize new building techniques.

The funding of strategic project pre-planning puts a lot of pressure on starting to construct the assets quickly, so businesses are performing project stage planning at a very late stage. It results in the modular construction market growth being badly impacted, as owners have already made their decisions to use traditional construction methods.

Another hindrance followed the total shutdown of the COVID-19 pandemic, which introduced volatility and uncertainty in the construction industry market, badly impacting the prefabrication and modular construction segment, due to a decline in new residential and non-residential constructions. The major countries affected were India, China, the U.S., Italy, Israel, and the U.K.

The market is segmented into permanent modular construction (PMC) and relocatable modular construction.

PMC represents the highest market share and is the fastest-growing industry segment. The PMC modules can:

The materials used in the market are:

In 2022, concrete was the largest materials segment, due to the increasing demand for concrete materials, to build road and highway infrastructures.

Start-ups in emerging countries are growing fast, resulting in the progress of the commercial sector. The applications market is divided into:

Asia Pacific is the fastest-growing region over the projected period. The regional market is anticipated to be driven by expanding building activity due to increased demand from the residential and commercial sectors.

Prefabrication and modular construction are popular worldwide, allowing high quality and leading to increased market acceptance, as they:

The need for cost-effective prefabrication and modular construction technologies, to ensure uniform quality, has significantly increased the demand for using these methods, facilitating:

The growth of prefabrication and modular constructions is boosted by:

Unfortunately, the prefabrication and modular constructions are not popular in regions prone to earthquakes, due to their unproven reliability. As a result, the market development of modular construction is not growing as fast as it could.

During the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were affected, resulting in lower activities for the prefabrication and modular construction market. Fortunately, construction companies are now operating at full capacity, which helped the prefabrication and modular construction market to get back to growth.

Permanent prefabrication and modular constructions have registered the highest revenue, and re-locatable constructions are expected to grow at a significant rate.

Permanent modular houses are inexpensive and simple to build. They:

The increasing trend of green buildings and new infrastructures across developed countries, such as the U.S., the UK, France, and Germany, is forecasted to create worthwhile opportunities for the expansion of the permanent modular construction industry thanks to initiatives like:

For example, the company BIG was commissioned to design Dortheavej in 2013 by Danish non-profit affordable housing association Lejerbo, whose mission was drafted by Danish urban space designer Jan Gehl. BIG was asked to:

BIG and Lejerbo were honored by the Danish Association of Architects with the Lille Arne Award for prioritizing the spatial qualities of the residences and the building strategy on a strict affordable housing budget, using prefabrication and modular construction methods.

BIG's founding partner, Bjarke Ingels said:

Affordable housing is an architectural challenge due to the necessary budget restrictions. We have attempted to mobilize modular construction with modest materials to create generous living spaces at the urban as well as the residential scale. The prefabricated elements are stacked in a way that allows every second module an extra meter of room height, making the kitchen-living areas unusually spacious. By gently adjusting the modules, the living areas open more towards the courtyard while curving the linear block away from the street to expand the sidewalk into a public square. Economical constraints often lead to scarcity—at Dortheavej, we have managed to create added value for the individual as well as the community.

Major companies in the market offer new quality products and better services to customers in the modular construction market. They are:

Prefabrication and Modular concepts are used in many types of construction projects, like:

In prefabrication and modular construction, the supply chain reactions are more predictable than in traditional construction, as the construction process is centralized and:

In the construction industry labor shortage has been a trend for a while, but not as bad in the prefabrication and modular construction industry. The methods enable new employees to be easily trained on how to assemble standard modules. When trained they become efficient very quickly.

Prefabrication and modular construction projects deliver:

Prefabrication and modular constructions are very good at responding to changes in the construction industry as they provide high-quality and affordable options.

The popularity of prefabrication and modular construction will accelerate when:

Developers and contractors can recommend moving to prefabrication and modular construction when it is appropriate, so they can:

Driving Vision's technology appraisal looks at the best way to insert new technology in your workflows and how to move your organization to cloud computing so you can open new possibilities for your daily planning tasks and make sure your data never leaves the optimally secured data center.

A Driving Vision expert will conduct the interviews online and will discuss the report with you. Together we will decide the best way to implement the solutions at your pace and according to your budget.

Implementing BIM can be daunting, but Driving Vision is here to help you at the pace you are comfortable with. Get started by getting in touch now

Seamless Data Transfer

Enhances collaboration between team members

Allows you to build green constructible assets on budget and on time